COVID19 – Threat is the Virus, not the People

COVID19 is the most used word in the past half-a-year and the impact is everywhere in the world. Most of the people have lost their source of income due to decline in various industries with a huge impact on workforce. The most effected people are from middle class, lower middle class and lower class. Anyways there are quite few reasons for the business decline during the COVID19 pandemic this year which you must know. Here are the top 5 industries that really got huge impact over the pandemic. Also see how businesses should prepare for next pandemic.

COVID19 Impact: Top 5 Areas

- Education

- Automotive

- Insurance

- Real Estate

- Environment

Education

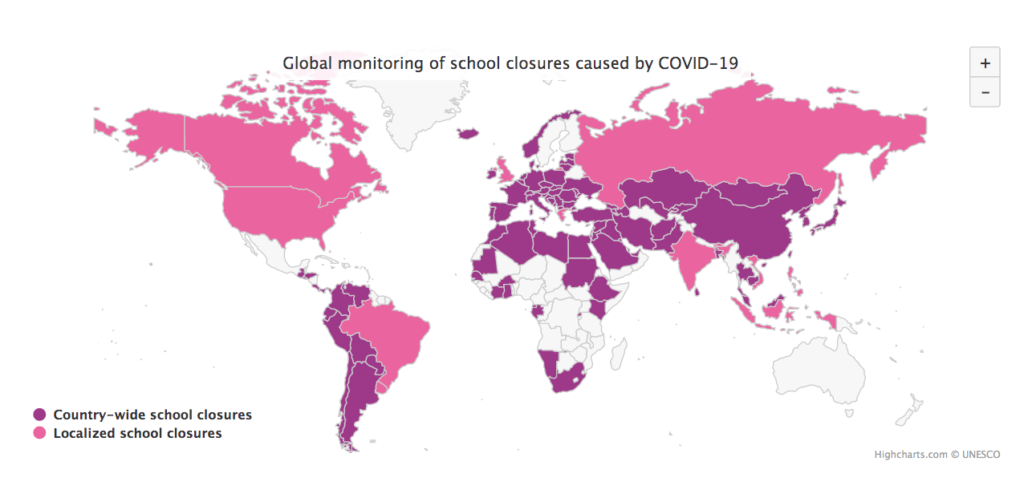

About 91% of students in more than 188 countries around the world are staying at home as schools remained closed for many days. The education sector faced unparalleled challenges due to COVID19 and need to adopt some new technologies to keep children engaged on their way to learning and find solutions. Many questions will be in mind – when can these problems be addressed and what will children continue to learn with this new normal of the school becoming a digital space by necessity? It is a fact that School-going children are of course the worst-affected actors in the education sector.

The lockdown doesn’t simply mean a reduced cashflow or a professional setback for pupils but represents an interruption of their learning journey at schools or home. The shutdown has intensified social and deep-set class disparities, especially between private and public school systems. Most of the students from the middle class and lower class who joined schools will certainly have no access to home teaching facilities for remote and digital learning. The pandemic is unexpected – yet most of the schools adapted to e-learning and running classes online for a brighter career of each student.

Automotive

The corona pandemic has both struck auto manufacturers and industries with autonomous vehicles (AV), as demand for vehicles has fallen sharply and the near future seems uncertain. The estimates vary for how soon companies working in these industries will move forward and how much this dramatic business turbulence will survive.

Organizations continue to consider the introduction of technologies from the supply chain – such as freight control systems, warehouse management systems, automation and the transportation of self-employed products – to minimize staff density in their operations. As limited labor is extended in warehouses due to restricted capital, businesses need to look at the increasing output with a reduced headcount. Automation would be essential to improving efficiency and working resilience.

Organisations that emerge the strongest after COVID-19 will see the current emergency as an opportunity to reform their supply chains and allow the above-mentioned strategies. While the future is unpredictable and the collapse of tomorrow is already underway, opportunity favors the prepared.

Insurance

Due to substantial financial dislocations across asset classes and, at extreme scenarios, possible major rises in morbidity and mortality, COVID-19 may have significant effects on insurers .. Life insurers with high morbidity risks and mortality risk will especially be hit hard if it is difficult to contain the pandemic. In severe scenarios, mortality rates could trigger meaningful capital payouts. Widespread declines in asset ratings and consistently low interest rates will contribute to the difficult climate. Account management bodies should be responsible for shifts in insurance appetite. In a situation of widely downgraded bond ratings, regulators would closely track and reassess ties to rating behavior within supervisory systems, if appropriate, thus strengthening oversight for insurers of volatile assets. Assessments on financial stability would analyze the effect of the pandemic on insurers.

Real Estate

For globally reporting nations, it is not shocking that it has significantly impacted economies on an unprecedented scale. Investors are now dealing with growing numbers of people confined to their homes to come up with contingency plans to ensure their investments stay safe. The real estate industry appears to be the most impacted of all industries. Hotels, restaurants and stores are vacant now.

Market uncertainties can occur. As we experience, an important factor can have a large impact on the economy. Coronavirus or COVID-19 in this case. With no yet known remedy, immobilizers, home buyers and sellers can only wait to see what is coming from the virus and the real estate market. People should expect the worst for the moment and pray that their assets will not become liabilities.

Environment

The coronavirus epidemic this year has had a devastating impact on nations and societies worldwide. The way we work, communicate, shop and enjoy our spare time has changed — and it has bought us closer together in many ways.

Given the challenges we had to face with the help of COVID-19, a few silver linings have come to the fore, many of which we are now seeing. In particular, the environment has a lifeline, time off for recovery from heavy emissions and pollutants in the past.

Much media coverage was paid to the significantly reduced emissions of pollution from fewer road vehicles, but less media interest was placed on how our ecosystems and seas are being powered, considering the fact that the two are inextricably entangled by air and sea temperatures.

“Put a mask on & save the life of somebody” => “Adjust the climate now & take advantage of it later.”